Note: Placeholder is an investor in Decred.

Decred (DCR) is a cryptocurrency with hybrid proof-of-work/proof-of-stake consensus that enables on-chain governance. Its proof-of-work mining is similar to Bitcoin’s, except each block has to be approved by a randomly-selected group of users who “stake” their DCR. In addition to approving a block, these selected stakers can also vote on changes to Decred’s consensus protocol, allowing them to influence the long-term evolution of the network. This architecture creates a fair system of checks and balances between users, miners and developers.

To stake, users can purchase “tickets” with DCR using a Decred client. Every time a block is produced, five random tickets are chosen from the “ticket pool” to vote on the block’s validity. It requires at least 3 of 5 stakers to approve the block and add it to the chain, or alternatively, veto and discard it (in which case, the miner receives no reward).

Tickets are also used to vote on potential upgrades to the Decred protocol. Votes are tallied over 8,064 blocks (about 30 days) to allow for the entire ticket pool to participate, and it takes 75% approval for a change to go into effect.

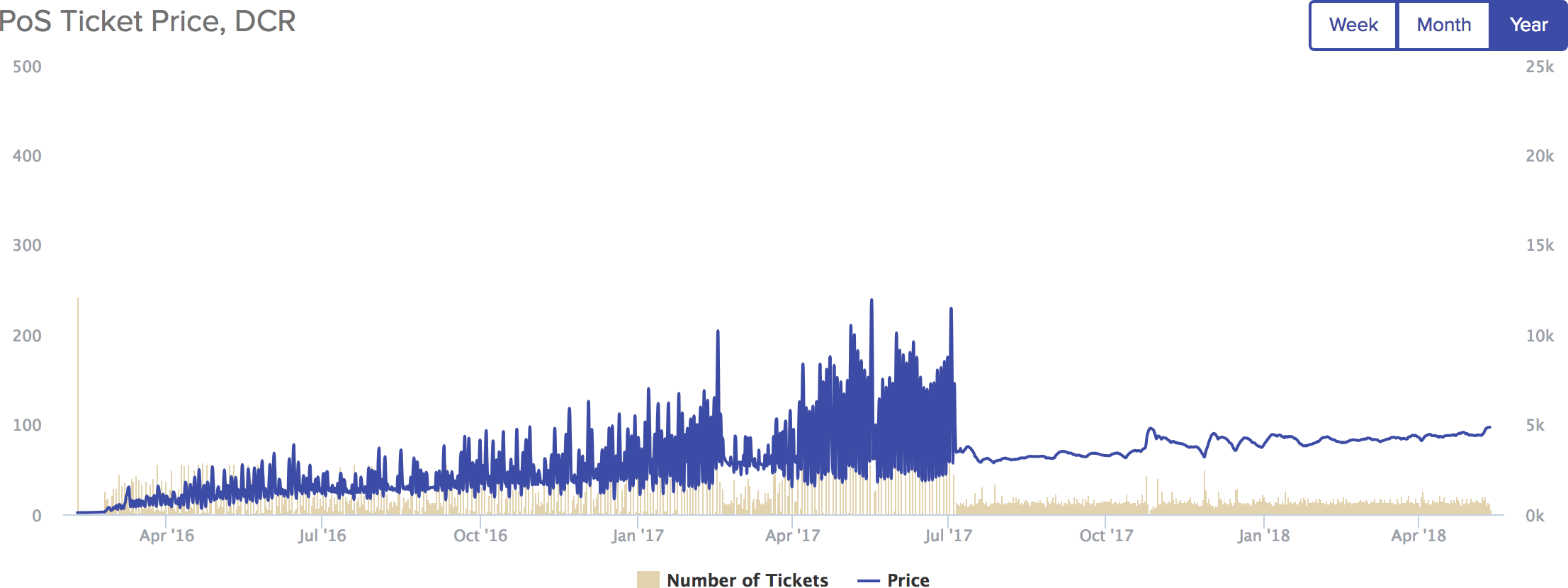

A market internal to the network determines the ticket price using a “stake difficulty algorithm,” which modulates the price of newly purchased tickets to maintain a target pool size of 40,960 tickets. The more people want to participate in Decred’s governance by purchasing tickets, the higher the price of a ticket.

After voting, tickets are destroyed, and their owners receive the purchase price back plus a share of the block reward as compensation for participating in the consensus process. If a ticket isn’t called, or fails to vote after 40,960 blocks (about 142 days), its owner receives a refund, but no reward.

Figure 1: The price of tickets has increased from around 2 DCR per ticket at network launch to around 90 DCR today, showing the increasing value of participating in Decred’s governance.

Decred’s “best-in-class-governance” came out of frustration with Bitcoin’s consolidated power structure, where a small group of core developers and miners have control, and the users’ ability to directly influence the protocol is limited.

In 2013, Decred’s founding team (formerly Conformal Systems LLC, now known as Company 0) built an alternative implementation to Bitcoin Core called btcsuite, written in Go instead of C++. Despite its technical merits, btcsuite was rejected by much of the Bitcoin Core community, and there was no clear path to reconciliation.

Meanwhile, an anonymous member of the Bitcointalk forum known as tacotime began working on memcoin2, one of the first cryptocurrencies to propose a hybrid consensus protocol that “affords eventual democratic control of the monetary supply to the userbase through participatory voting.”

In early 2014, tacotime and _ingsoc, another anonymous Bitcointalk member, connected with Jake at Conformal Systems to discuss memcoin2 and the idea of “decentralized credits”. Tacotime helped lay the groundwork for Decred before founding Monero with a few others in April 2014, while Conformal Systems, inspired by the promise of a better-governed cryptocurrency, switched focus from btcsuite to the new project.

After almost two years of work, Jake published a reflection on Bitcoin’s three main weaknesses – governance, funding, and miners having too much power – and hinted at the release of a new cryptocurrency to address these concerns.

Decred launched in February 2016. There was no token sale or venture capital financing, instead Company 0, the new development company, funded the work with $1.5M of its own money. At launch, the team created 8% of the ultimate supply of 21 million coins, giving away half to ~3,000 early adopters and using the other half to pay back development costs.

The remaining 92% of DCR supply is now being mined over time, with each block reward split 60/30/10 between miners, stakers and the Decred development pool. It is a prime example of inflation funding: the development pool currently holds over $40 million worth of DCR to fund long-term projects, and it will grow together with the market’s confidence in the network. By choosing not to pre-sell coins to speculators, the financial rewards from Decred’s growth most favor those who work for the network.

Almost 50% of all DCR outstanding is staked, showcasing the community’s commitment and relative lack of speculative activity, as staking requires locking up DCR for an average of 28 days.

Figure 2: The percent of DCR staked has more than doubled since launch.

On the hardware side of the network, Decred’s hash-rate is exploding, up about 19x in 2018 alone, as ASIC miners tailored for its Blake256 hashing algorithm come online.

Figure 3: ASIC-based mining rigs started shipping for Decred in 2018, placing it in a period akin to what happened to Bitcoin’s hash-rate in 2013.

On the community side, Politeia, a transparent proposal system, is nearing mainnet approval. Politeia allows stakers to nominate and fund various kinds of proposals, like R&D grants, application interfaces, organizing community gatherings, exchange integrations, and so on.

While Decred remains somewhat under-the-radar, there are many reasons to be bullish about the cryptocurrency’s future. In all of our interactions with the Decred team, we’ve been impressed with the consistent candor of their culture, earnest commitment to the network, and in Jimmy Song’s words, roster of “amazing developers.”

As they ramp up an effort to push Decred further into the crypto-mainstream, the list of upcoming features is growing, and the 2018 roadmap is a testament to the network’s ambitions. Private transactions on-par with the privacy coins, community control over funds, Lightning Network support and a decentralized exchange are all in store, along with various platform and performance improvements. It’s too early to tell how all of this functionality is going to converge, but we’re excited to be part of a community of users engaged in the decision-making process and working with a devoted development team.

Decred’s killer feature is good governance, and with good governance, you can have any feature you want.